What are the Asset Classes?

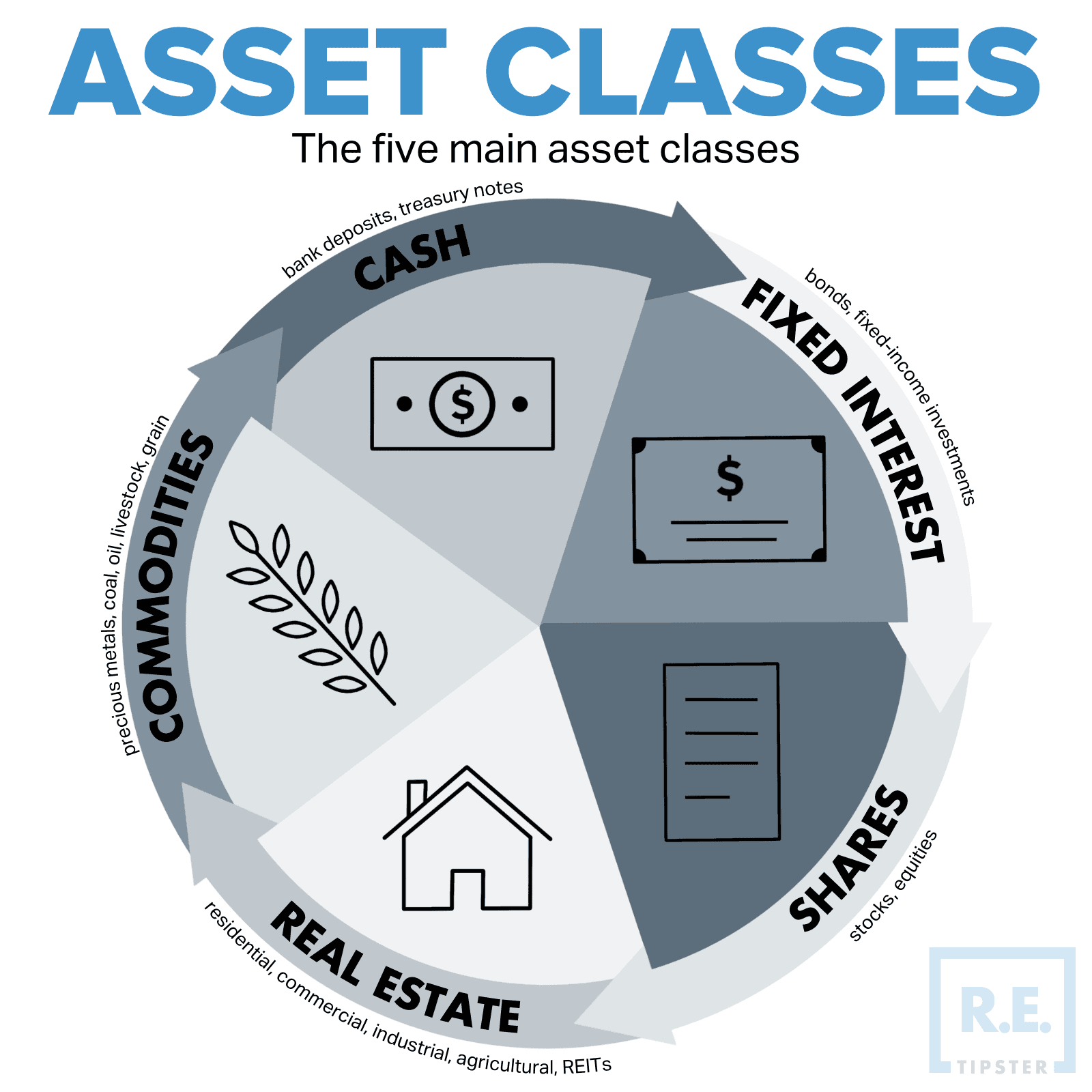

Asset classes are broad categories of investment instruments or types of assets that share similar characteristics and behave in similar ways within the financial markets. These asset classes are used by investors to diversify their portfolios, manage risk, and pursue specific investment objectives. Some common asset classes include:

- Equities or stocks: Ownership shares in publicly traded companies, which represent ownership in a company and potential for capital appreciation and dividends. If we classified Stocks then there are following types: –

- Common Stock: This is the most common type of stock and represents ownership in a company. Common stockholders have voting rights and may receive dividends, but their claims on the company’s assets and earnings are subordinate to those of preferred stockholders and bondholders.

- Preferred Stock: This type of stock typically pays a fixed dividend to stockholders before any dividends are paid to common stockholders. Preferred stockholders generally do not have voting rights but have priority over common stockholders in terms of claims on assets and earnings.

- Blue-chip Stocks: These are shares of well-established companies with a long history of stable earnings and dividends. Blue-chip stocks are considered relatively safe investments and are often known for their stability and reliability.

- Growth Stocks: These are shares of companies that are expected to experience above-average growth in earnings and revenue. Growth stocks typically reinvest their profits into expanding their operations, and investors may be attracted to them for their potential for capital appreciation, although they may also carry higher risks.

- Value Stocks: These are shares of companies that are considered undervalued based on fundamental analysis, such as low price-to-earnings (P/E) ratios or price-to-book (P/B) ratios. Value stocks are often associated with companies that are mature and may be overlooked by the broader market, but have the potential for long-term growth.

- Small-cap, Mid-cap, and Large-cap Stocks: Stocks can be categorized based on the size of the companies they represent. Small-cap stocks represent smaller companies with smaller market capitalization, mid-cap stocks represent medium-sized companies, and large-cap stocks represent large, well-established companies.

- Penny Stocks: These are stocks with low prices, typically trading at less than $5 per share. Penny stocks are often associated with higher risks due to their lower liquidity, smaller market capitalization, and higher volatility.

- Dividend Stocks: These are stocks that pay regular dividends to shareholders. Dividend stocks are popular among income-oriented investors who seek regular income from their investments, although not all stocks pay dividends.

- Cyclical Stocks: These are stocks of companies whose performance is closely tied to the business cycle. For example, companies in industries such as construction, automotive, or consumer discretionary tend to be more cyclical as their revenues and profits may fluctuate with changes in economic conditions.

- Defensive Stocks: These are stocks of companies that are relatively less affected by changes in the business cycle and are considered more stable during economic downturns. Examples of defensive stocks include companies in the utilities, consumer staples, and healthcare sectors.

- Fixed Income or Bonds: Debt securities issued by governments, corporations, or other entities, which pay periodic interest and return the principal at maturity. Following are the types of fixed income or bond: –

- Government Bonds: These are bonds issued by the Government of India or state governments. They are considered to be relatively low-risk investments as they are backed by the government’s creditworthiness. Government bonds in India include Sovereign Gold Bonds, Savings Bonds, and State Development Loans (SDLs) issued by state governments.

- Corporate Bonds: These are bonds issued by companies to raise capital. Corporate bonds in India can be issued by both private and public sector companies, and they offer varying levels of risk and returns depending on the creditworthiness of the issuer. Corporate bonds can be further categorized into secured or unsecured, convertible or non-convertible, and listed or unlisted bonds.

- Municipal Bonds: These are bonds issued by local government bodies such as municipal corporations, municipal councils, and other local authorities. Municipal bonds in India are relatively less common compared to government and corporate bonds.

- Infrastructure Bonds: These are bonds issued by companies or financial institutions specifically for financing infrastructure projects in India. Infrastructure bonds are designed to attract investment in the development of infrastructure sectors such as transportation, power, and communication.

- Tax-Free Bonds: These are bonds issued by government-owned entities or government-backed institutions that offer tax-free interest income to investors. Tax-free bonds in India are generally long-term investments and are exempt from income tax on the interest earned, making them attractive to certain investors.

- Debentures: These are long-term debt instruments issued by companies that are not secured by any specific asset. Debentures in India can be either convertible or non-convertible, and they may offer fixed or floating interest rates.

- Cash and Cash Equivalents: Short-term investments that are considered relatively safe and liquid, such as cash, savings accounts, money market funds, and short-term government bonds. In India, cash and cash equivalents may include the following types: –

- Physical cash: This includes banknotes and coins that are held by a company or an individual for use in day-to-day transactions.

- Savings accounts: These are bank accounts that allow individuals or companies to deposit and withdraw money easily. Savings accounts typically earn interest on the deposited amount, and the funds can be accessed using checks, ATM withdrawals, or electronic transfers.

- Current accounts: These are bank accounts that are primarily used by businesses for conducting day-to-day transactions, such as making payments to suppliers or receiving payments from customers. Current accounts usually do not earn interest and may have higher transaction fees compared to savings accounts.

- Fixed deposits: Also known as term deposits, fixed deposits are investment instruments offered by banks where a fixed amount of money is deposited for a specified period of time, usually ranging from a few months to a few years. Fixed deposits generally earn higher interest rates compared to savings accounts, but the funds are locked-in for the specified term.

- Money market mutual funds: These are investment funds that invest in short-term debt instruments, such as commercial paper, treasury bills, and certificates of deposit. Money market mutual funds are considered to be cash equivalents as they are highly liquid and can be easily converted to cash.

- Treasury bills: These are short-term government securities issued by the Reserve Bank of India (RBI) on behalf of the Government of India. Treasury bills are considered to be very low-risk investments and are often used as cash equivalents by companies and individuals.

- Cash equivalents with maturities of three months or less: These can include any short-term investments that are highly liquid and have maturities of three months or less, such as commercial paper, short-term bonds, and other money market instruments.

- Real Estate: Physical property or land, including residential, commercial, and industrial properties, which can generate income through rent or appreciation in value. Some common types of real estate in India are: –

- Residential properties: These are properties that are used for residential purposes, such as apartments, houses, and residential plots. Residential properties can be owned and used by individuals or families for living or as an investment for rental income.

- Commercial properties: These are properties that are used for commercial or business purposes, such as office spaces, retail stores, shopping malls, and hotels. Commercial properties are typically used by businesses or investors to generate rental income or for conducting business activities.

- Industrial properties: These are properties that are used for industrial or manufacturing purposes, such as factories, warehouses, and industrial plots. Industrial properties are used by businesses involved in manufacturing, production, storage, or distribution of goods.

- Agricultural properties: These are properties that are used for agricultural purposes, such as agricultural land, farms, and plantations. Agricultural properties are used for farming activities, cultivation of crops, and rearing of livestock.

- Special purpose properties: These are properties that are designed and used for specific purposes, such as hospitals, educational institutions, religious buildings, and government buildings. These properties may have specific legal, regulatory, and usage requirements.

- Vacant land: This refers to undeveloped land that does not have any structures built on it. Vacant land can be used for various purposes such as future development, agricultural activities, or investment purposes.

- Residential plots or sites: These are plots of land that are designated for residential development and are typically sold for the purpose of constructing homes. Residential plots or sites may be part of a larger residential development or standalone plots.

- Commercial plots or sites: These are plots of land that are designated for commercial development and are typically sold for the purpose of constructing commercial or business properties, such as offices, shops, or hotels.

- Commodities: Physical assets such as gold, silver, oil, agricultural products, and other natural resources that are used as raw materials or traded in commodity markets. Some of the major commodity types in include: –

- Agricultural Commodities: India is known for its agricultural sector, and agricultural commodities are a significant part of its economy. This includes cereals such as rice, wheat, and maize, pulses like lentils and beans, oilseeds like mustard and groundnut, spices like cardamom and black pepper, sugar, cotton, tea, coffee, and various fruits and vegetables.

- Metals and Minerals: India has significant reserves of various metals and minerals, and they are important commodities. This includes iron ore, coal, bauxite, copper, zinc, lead, gold, silver, and other precious and base metals.

- Energy Commodities: With a growing demand for energy, India trades various energy commodities. This includes crude oil, natural gas, coal, and electricity.

- Bullion: Gold and silver are considered as bullion, which are traded as commodities in India. India has a significant demand for gold due to cultural, religious, and investment reasons.

- Industrial Commodities: India also produces and trades industrial commodities such as cement, steel, chemicals, fertilizers, and plastics.

- Edible Oils: Edible oils such as palm oil, soybean oil, sunflower oil, and mustard oil are important commodities in India, as they are widely used in cooking and food processing.

- Poultry and Livestock: Poultry and livestock, including chicken, eggs, and meat, are also significant commodities in India, as they are consumed widely for food.

- Textiles: Textile commodities, including cotton, silk, wool, and jute, are important in India, as the country has a large textile industry.

- Forest Produce: India has rich forest resources, and forest produce such as timber, bamboo, resin, and medicinal plants are traded as commodities.

- Dairy Products: Dairy products such as milk, butter, cheese, and ghee are important commodities in India, as dairy farming is a significant agricultural activity.

- Alternative Investments: Non-traditional asset classes such as hedge funds, private equity, venture capital, and other specialized investments that are not typically traded in public markets and may have unique risk and return characteristics. Some popular types of alternative investments include: –

- Real Estate: Real estate is a common alternative investment option in India, encompassing residential, commercial, and industrial properties. Real estate investments can generate income through rental yields, and also offer the potential for capital appreciation over time.

- Private Equity (PE): Private Equity involves investing in privately held companies with the aim of acquiring ownership stakes and generating returns through capital appreciation. PE investments are typically made in early-stage, growth-stage, or mature companies with high growth potential.

- Venture Capital (VC): Venture Capital involves investing in early-stage companies that are typically in their high-risk, high-reward phase. VC investments are made in companies with innovative business models or technologies, and the aim is to generate substantial returns through capital appreciation.

- Hedge Funds: Hedge funds are privately managed investment funds that employ various investment strategies to generate returns. These strategies may include long/short equity, global macro, event-driven, and arbitrage, among others. Hedge funds are typically open only to accredited or sophisticated investors in India.

- Commodities: Investing in commodities such as gold, silver, crude oil, and agricultural products can also be considered an alternative investment option in India. Commodity investments can provide diversification to an investment portfolio and act as a hedge against inflation.

- Art and Collectibles: Investments in art, antiques, and other collectibles are gaining popularity in India as alternative investment options. These investments can provide potential returns through capital appreciation and are typically considered a long-term investment.

- Cryptocurrencies: Cryptocurrencies, such as Bitcoin and Ethereum, are also gaining traction as alternative investment options in India. However, they are highly speculative and volatile in nature and come with higher risks compared to traditional investments.

Summary – Risk and return characteristics of each asset class can vary depending on market conditions, economic factors, and other variables. Making diversification across the different asset classes can help to manage risk and optimize investment portfolios based on individual financial goals and risk tolerance. It’s always advisable to consult with a qualified financial professional before making any investment decisions.

For any query or investment advice feel free to contact us @ moneysmint99@gmail.com